As a young collector, his focus was much different and his earlier acquisitions no longer fit the current goals of his collection. John has built a collection of abstract art over 40 years. If you have held your art or other collectible for more than one year as an investment (i.e., you are not the artist), then your charitable donation of art or another collectible to a donor-advised fund may provide you with the following benefits, including:Ĭase study: achieving strategic planning advantages

Benefits of a donation to a donor-advised fund

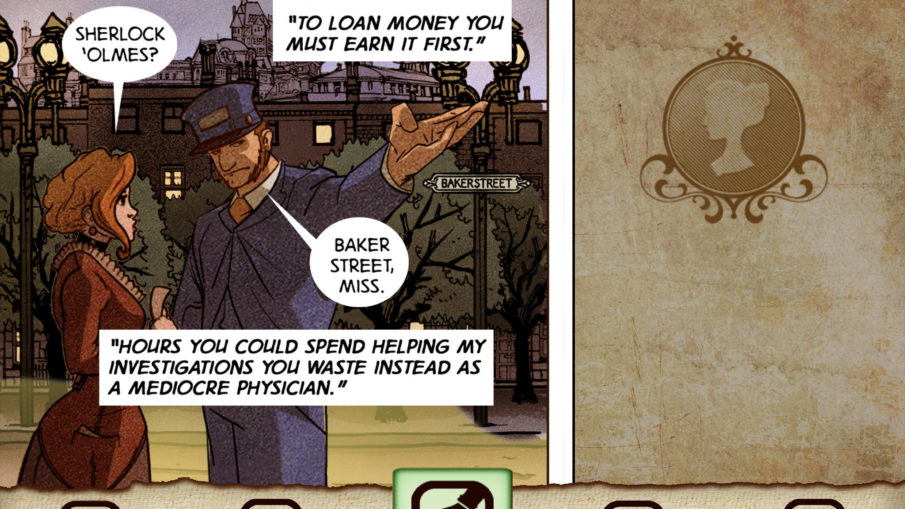

LEARNING THE ART OF DEDUCTION PLUS

Why? Because the maximum capital gains tax rate applicable to art and collectibles held longer than one year is 31.8% (28% long-term capital gains rate plus Medicare surtax of 3.8%), which is higher than the maximum 23.8% rate for other capital assets, such as long-term held publicly traded stock or real estate. Please consult with your tax or legal advisor on your specific situation.Įven if your income tax deduction is limited to the lesser of cost basis and fair market value, you may find that the key benefit to an art donation (where held more than one year) is the potential elimination of capital gains taxes. If you itemize your deductions and need a charitable deduction more than elimination of capital gains tax liability (e.g., your basis is high with limited or no appreciation), then it may make more sense for you to sell your art, recognize any taxable gains, and then make a cash gift of net proceeds to charity. When weighing the pros and cons of donating art to charity you might consider whether the need for a charitable deduction outweighs the importance of minimizing capital gains taxes if the art were sold. What is the related use rule? Generally, if you donate art or collectibles to a charity that does not use the gift as part of its charitable purpose, then your deduction is limited to the lesser of cost basis (the value at which you acquired or inherited the art) and fair market value. You should be aware of the IRS’s “related use” rule, which may impact the value of your charitable income tax deduction when donating art (or other collectibles) to a donor-advised fund or other public charity.

Special tax rules may apply to gifts of art and collectibles Please consult with your tax or legal advisor. In addition, all gifts to donor-advised funds are irrevocable. This article is only intended to be a general overview of some donation considerations and is not intended to provide tax or legal guidance. Please be aware that gifts of appreciated non-cash assets can involve complicated tax analysis and advanced planning. Qualified Charitable Distributions (QCDs) – What You Need to Know.Enhance Your Offer with Charitable Planning.Private Foundations and Donor-Advised Funds.Eight ways to increase giving power and reduce taxable income

0 kommentar(er)

0 kommentar(er)